SPEAK TO AN ADVISOR

Tax considerations for exit planning

Tax considerations for exit planning

On-demand- This webinar was previously broadcasted on - Tuesday 11th July, 2023

How well do you think you know your clients? Do you know how they would plan to exit their company?

Will it be a third-party sale, a company purchase of own shares, a management buy-out, a sale to an employee ownership trust or a member’s voluntary liquidation?

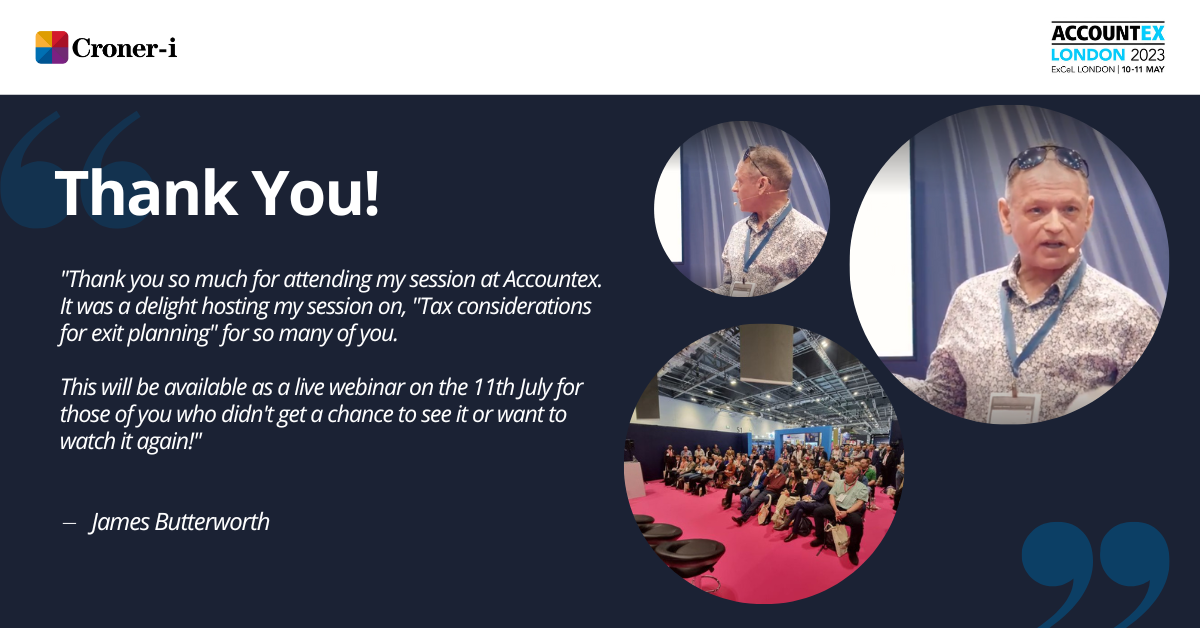

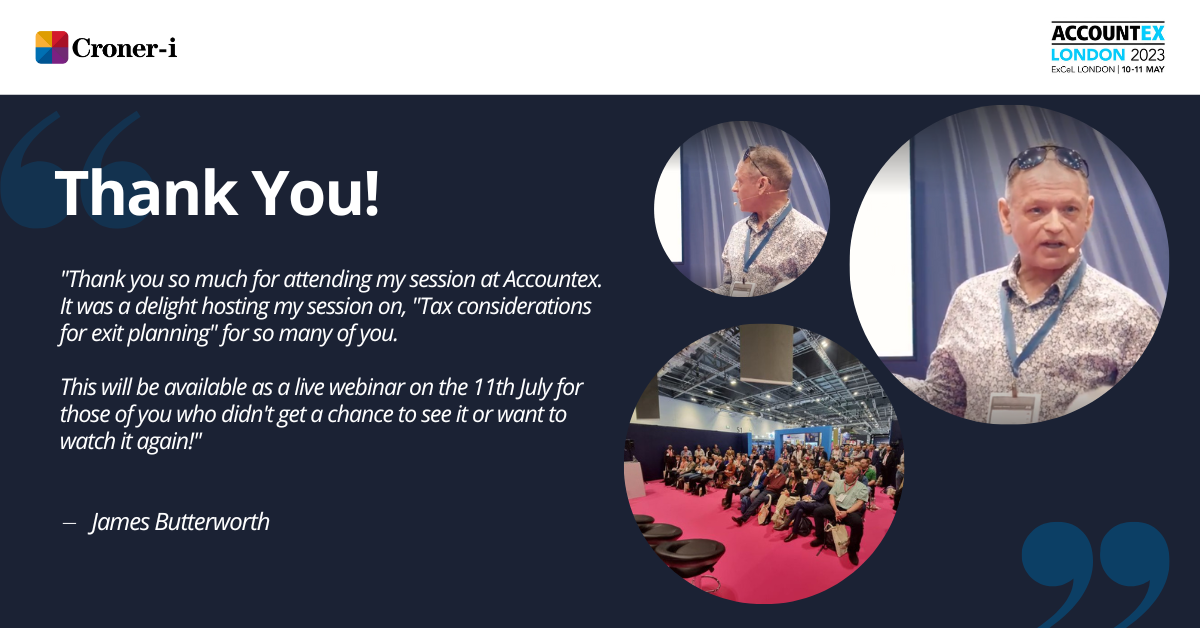

Our VIP tax expert, James Butterworth, will be giving an overview of the main considerations of each of these options to ensure that you maximise on your client’s exit strategy in a free webinar on Tuesday 11th July, 2023 2:00 PM - 3:00 PM

James had an amazing time presenting this session at Accountex, it seemed like hundreds of accountants attended...

What will I learn?

James Butterworth

VIP Tax Expert

How well do you think you know your clients? Do you know how they would plan to exit their company?

Will it be a third-party sale, a company purchase of own shares, a management buy-out, a sale to an employee ownership trust or a member’s voluntary liquidation?

Our VIP tax expert, James Butterworth, will be giving an overview of the main considerations of each of these options to ensure that you maximise on your client’s exit strategy in a free webinar on Tuesday 11th July, 2023 2:00 PM - 3:00 PM

James had an amazing time presenting this session at Accountex, it seemed like hundreds of accountants attended...

What will I learn?

From this webinar you will gain a better understanding of:

- Capital gains on disposal of shares and Business Asset Disposal Relief

- Earn out situations and potential risks

- Gifts of shares including CGT gift relief and IHT considerations

- Company purchase of own shares and alternative suggestions

- MBO arrangements

- Use of employee ownership trusts

- Advance tax clearance applications

- Liquidation distributions and anti-avoidance

James Butterworth

VIP Tax Expert